how to rebuild life after divorce

Financial Planning and Stability

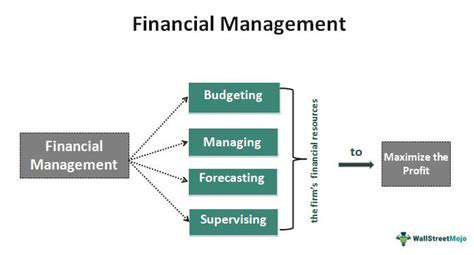

Importance of Financial Planning

Effective financial planning is crucial for achieving long-term financial stability and security. It involves a comprehensive strategy for managing your income, expenses, and assets. This proactive approach allows you to anticipate future needs and make informed decisions about your financial future. A well-structured plan provides a roadmap to navigate financial challenges and capitalize on opportunities. By understanding your financial goals and developing a realistic plan, you can work towards achieving financial independence and freedom.

Financial planning encompasses various aspects, from budgeting and saving to investing and debt management. It allows you to allocate resources effectively and make informed choices about your spending habits. This process requires careful analysis of your current financial situation, including income, expenses, assets, and liabilities. It also involves setting clear financial goals, such as buying a home, funding your children's education, or retiring comfortably. Proactively addressing your financial needs and goals is an essential step toward a secure financial future.

Building a Solid Financial Foundation

A solid financial foundation is the cornerstone of long-term stability. This involves developing strong saving habits, establishing an emergency fund, and creating a budget that aligns with your income and expenses. Understanding your income and expenses is essential for creating a realistic budget and identifying areas where you can reduce unnecessary spending. This allows you to allocate resources effectively toward your financial goals and maintain a healthy financial posture.

Managing debt effectively is also a critical component of building a strong financial foundation. Developing a strategy for repaying high-interest debts, such as credit card debt, can significantly impact your overall financial health. Prioritizing debt repayment can free up cash flow for other important financial activities. By creating and maintaining a realistic budget, you can work towards minimizing debt and maximizing your financial resources.

Strategies for Achieving Financial Stability

Investing wisely is a key strategy for achieving long-term financial stability. By diversifying your investments and understanding different investment vehicles, you can potentially grow your wealth over time. Choosing appropriate investment strategies based on your risk tolerance and financial goals is essential. Understanding the different types of investments available and the associated risks can help you make informed decisions. It's important to remember that investment strategies should be tailored to your individual circumstances and goals.

Regularly reviewing and adjusting your financial plan is crucial for maintaining stability. Life circumstances change, and your financial plan should adapt accordingly. Reviewing your budget and investment portfolio at least annually allows for adjustments and ensures your plan remains aligned with your current needs and goals. This allows you to make necessary changes to your strategy, stay on track, and achieve financial success.

Seeking professional financial advice can be a valuable tool for achieving financial stability. A qualified financial advisor can provide personalized guidance and support in developing and implementing a plan tailored to your specific needs. They can offer expert insights and strategies to address complex financial situations and help you achieve your goals. A professional advisor can provide objective guidance and support, helping you make informed decisions that align with your financial objectives.

Read more about how to rebuild life after divorce

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases