How to Survive a Difficult Divorce

Sleep: Your Secret Superpower

Those precious hours of shut-eye are when your brain files memories, your muscles repair, and your emotions reset. Most adults need 7-9 hours, but quality matters as much as quantity. Try winding down with a book instead of screens, keeping your bedroom cool and dark, and sticking to consistent bedtimes - even on weekends.

Your Personal Support Team

No one thrives alone. The people who really listen when you talk, who celebrate your wins and help you through tough times - these relationships are priceless. Don't wait for crisis to reach out. Regular coffee dates, phone calls, or even text check-ins keep these connections strong.

Lighting designers know that combining different light sources creates depth and warmth in any room.

Managing Finances and Legal Matters Effectively

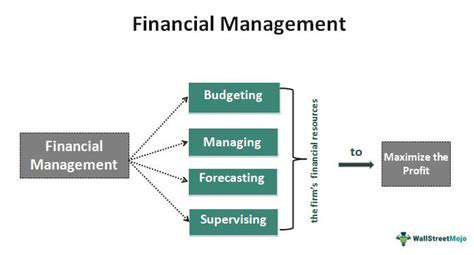

Budgeting Without the Headache

Money management starts with awareness. Tracking where every dollar goes for just one month can reveal surprising spending patterns. Use a simple notebook, spreadsheet, or app - whatever works for you. The goal isn't restriction, but making sure your spending aligns with what matters most to you.

Review your budget monthly - life changes, and your money plan should too. Got a raise? Maybe boost savings. Unexpected car repair? Time to adjust other categories. Flexibility prevents frustration.

Decoding Legal Jargon

Contracts and legal papers can feel like they're written in another language. Before signing anything important, read it aloud slowly - this often makes confusing terms clearer. Look up unfamiliar words, and don't hesitate to ask for explanations in plain English.

For major decisions - buying property, drafting a will, or complex agreements - a lawyer's expertise can save you from costly mistakes down the road. Think of it as insurance for your future.

Conquering Debt Step by Step

Debt feels overwhelming when viewed as one giant sum. Try this: list all debts from smallest to largest, regardless of interest rate. Pay minimums on all, then throw extra money at the smallest debt first. That first paid in full creates momentum.

If high-interest debts are crushing you, explore options. Sometimes consolidating multiple payments into one lower-interest loan can provide breathing room. Just beware of scams promising instant fixes.

Planning for Life's What-Ifs

No one likes thinking about worst-case scenarios, but preparation brings peace. A basic will ensures your wishes are known, especially if you have children or own property. Keep important documents where loved ones can find them - consider a fireproof box or secure digital storage.

Guarding Your Digital Footprint

In our connected world, using unique passwords for every account is no longer optional - it's essential self-defense. A password manager can handle the memorization for you. Be skeptical of urgent emails requesting personal info - when in doubt, contact the company directly.

When to Call in the Pros

Just as you'd see a doctor for persistent pain, financial advisors and attorneys can diagnose money and legal issues before they become emergencies. Many offer free initial consultations - come prepared with specific questions to make the most of your time.