practical ex relationship advice after divorce

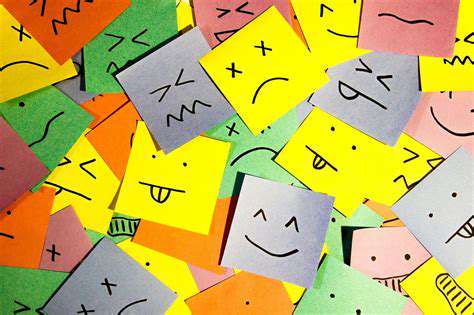

Navigating Emotional Waters

When a marriage ends, it's like losing a part of yourself. The pain of divorce cuts deep, leaving scars that take time to heal. I remember waking up each morning with this heavy weight in my chest - some days it was anger, other days just overwhelming sadness. What helped me most was giving myself permission to feel whatever came up, without judgment. My therapist kept reminding me: Emotions aren't good or bad, they just are.

There's no magic timeline for getting over a divorce. For me, the intense pain lasted about eight months before I noticed the mornings getting a little easier. A friend of mine took nearly two years before she felt like herself again. The key is being gentle with yourself through the process.

Rediscovering Who You Are

After fifteen years as Mark's wife, I had to figure out who Jessica really was. At first, this terrified me - I'd built my whole identity around our relationship. Then one rainy Tuesday, I signed up for a pottery class on a whim. The feeling of clay between my fingers awakened something I'd forgotten existed.

Reconnecting with old passions and discovering new ones became my lifeline. I started hiking every weekend, something my ex had never enjoyed. I reorganized my entire living space to reflect my personal style rather than our taste. These small acts of self-definition helped rebuild my confidence piece by piece.

Financial Fresh Start

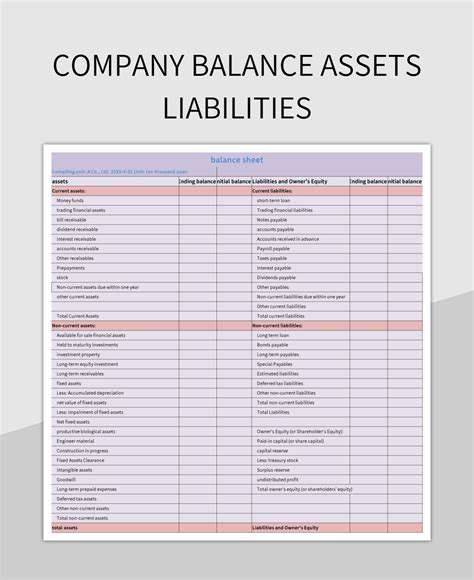

Money matters after divorce can feel overwhelming. When I first saw my new financial reality, I panicked. The joint accounts were gone, the household income halved. I spent three full days crying over spreadsheets before realizing I needed a plan.

Here's what worked for me:- I met with a financial advisor who specialized in post-divorce planning- Created a bare-bones budget, then gradually adjusted it as I adapted- Sold some furniture we'd fought over in mediation - the money funded my first solo vacation

Understanding exactly where I stood financially gave me back a sense of control. It wasn't easy, but six months later I was managing better than I'd expected.

Leaning On Your People

I'll never forget the Wednesday night my best friend showed up with takeout and a box of tissues. She didn't offer advice, just sat with me while I sobbed. That's the kind of support that gets you through.

I also found unexpected comfort in a divorce support group at my local community center. Hearing others' stories reminded me I wasn't alone in this struggle. Some of those women became my closest friends - we still meet monthly for what we jokingly call the ex-files.

Creating New Traditions

The first Christmas after my divorce was brutal. All our usual traditions felt hollow without him there. So I invented new ones - I volunteered at a soup kitchen in the morning, then had an orphan's Christmas dinner with other single friends.

This became my approach to all the firsts - first birthday alone, first vacation solo, first anniversary of the divorce. By creating new rituals, I rewrote the script of my life. Now I actually look forward to my solo beach trips every August.

Looking Forward

Three years out, I can honestly say I'm happier than I was in my marriage. The journey wasn't linear - some days I took two steps forward and one step back. But gradually, the good days outnumbered the bad.

What surprised me most was discovering strengths I never knew I had. That terrified woman crying over divorce papers? She's now running her own small business, traveling the world, and yes - even dating again (when she feels like it).

Financial Rebuilding: Practical Steps Forward

Getting Financially Naked

The day I sat down with all my financial documents spread across the kitchen table was terrifying but necessary. I made three lists:1. All income sources (including that freelance gig I'd been treating as extra money)2. Every single expense - right down to the $4 monthly app subscription3. All debts with interest rates and minimum payments

Seeing everything in black and white was painful but empowering. I finally understood exactly where my money was going - and where I could make changes.

The 50/30/20 Method That Saved Me

After trying several budgeting methods, I landed on this simple approach:- 50% of income to needs (rent, utilities, groceries)- 30% to wants (that yoga class I loved)- 20% to savings/debt repayment

I used a basic spreadsheet to track everything at first. Now I swear by Mint for keeping me honest. The key was reviewing my spending every Sunday with a cup of tea - making it a ritual rather than a chore.

Tackling Debt Mountain

My $18,000 in credit card debt felt impossible until I tried the avalanche method:1. Listed all debts by interest rate2. Paid minimums on all but the highest-rate card3. Threw every extra dollar at that top debt

When I paid off that first card after nine months, I cried happy tears for the first time in a year. That momentum kept me going through the rest. Two years later, I made the final payment - and framed the statement.

Side Hustles That Actually Work

I discovered my corporate training skills translated well to freelance work. Starting small with just a few hours a week, I gradually built a consulting business that now covers my rent.

Other divorced friends found success with:- Renting out their spare room- Selling handmade crafts on Etsy- Pet sitting through Rover

The trick is finding something that doesn't feel like extra work but rather an extension of your interests.

When to Call in the Pros

After six months of struggling alone, I finally met with a financial planner. In just two sessions, she:- Identified tax savings I'd missed- Restructured my retirement contributions- Helped negotiate lower interest rates on my cards

That $300 investment saved me thousands in the long run. Sometimes professional help isn't a luxury - it's a necessity.

Read more about practical ex relationship advice after divorce

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases