Effective Strategies for Divorce Recovery

Categorize expenses ruthlessly: Survival (housing, groceries), Stability (insurance, debt payments), and Splurges (entertainment, vacations). Like a nutrition label exposes hidden sugars, this breakdown reveals financial empty calories draining your resources. Spotting these allows strategic cuts—perhaps downgrading cable rather than skipping retirement contributions.

Crafting a Budget That Breathes

Traditional budgets often fail because they're too restrictive—like crash diets triggering rebound binges. Instead, design a flexible spending plan with built-in realism. Allocate 50% to needs, 30% to wants, 20% to savings/debt—but customize these percentages to your life stage. A recent graduate might prioritize student loans, while empty nesters focus on retirement catch-up.

The envelope system gets a digital makeover: apps like YNAB or Mint create virtual envelopes for categories. Watching the Dining Out envelope shrink mid-month encourages homemade meals without outright deprivation. Regularly revisiting this system ensures it evolves with life changes—new parenthood demands different allocations than single adulthood.

Goal-Setting With Teeth

Vague aspirations (Be rich someday) lack motivational power. Instead, craft SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals with visceral appeal. Rather than Save for retirement, try Accumulate $12,000 in my Roth IRA by December 31st to secure future beachside margaritas. The more sensory details you attach—imagining the salt air, the clink of ice cubes—the harder your subconscious will work toward it.

Segment big goals into milestone rewards. Paying off $10,000 in debt might earn a weekend getaway, while reaching a six-month emergency fund justifies that coveted kitchen gadget. These celebrations reinforce positive financial behaviors like training treats for puppies.

Making Money Work While You Sleep

Investing shouldn't resemble casino gambling. Start with boring-but-brilliant basics: max out employer 401(k) matches (free money!), then explore low-cost index funds mirroring the S&P 500. Apps like Acorns round up purchases to invest spare change—painless entry points for beginners. Remember: the most successful investors are often dead people—they picked sensible strategies and didn't tinker.

As knowledge grows, diversify into real estate (REITs for hands-off exposure) or peer-to-peer lending. Always maintain an emergency fund buffer—investing should never jeopardize short-term security. Consulting a fee-only fiduciary ensures advice aligns with your best interests, not sales commissions.

Future-Proofing Your Golden Years

Retirement planning isn't about age—it's about financial independence. Use the 4% rule as a compass: estimate annual living expenses, multiply by 25 for your target nest egg. If you need $40,000 yearly from investments, aim for $1 million saved. Calculators like those at Investor.gov personalize this further based on your timeline and risk tolerance.

Take advantage of catch-up contributions at 50+, Health Savings Accounts (HSAs) for medical expenses, and Roth conversions in low-income years. Geographic arbitrage—retiring where costs are lower but quality of life remains high—can stretch savings further. Regularly revisiting these plans ensures they adapt to life expectancy increases and changing social security landscapes.

Legacy Building Beyond Dollars

Estate planning transcends mere asset distribution—it's your final message to the world. Beyond wills and trusts, consider ethical wills: letters sharing life lessons, family histories, and values. Digital legacy tools like Everplans organize passwords, final wishes, and even social media memorialization preferences.

For business owners, succession plans prevent family feuds. Philanthropically inclined? Donor-advised funds allow charitable giving with tax benefits. Update beneficiaries after major life events—an ex-spouse accidentally inheriting because you forgot to change forms happens more often than you'd think.

Breaking Debt's Grip

Not all debt is evil—mortgages and business loans can be strategic tools. But high-interest consumer debt acts like financial quicksand. Attack it with either the avalanche method (highest interest first, mathematically optimal) or snowball method (smallest balances first, psychological wins). Balance transfers to 0% APR cards can provide breathing room if disciplined.

Boost payments creatively: freelance gig income dedicated solely to debt, or no-spend months where discretionary funds become debt missiles. Once free, redirect those payments to investments—the amount that once drained you now builds your future.

Embracing the Opportunity for Personal Growth

The Alchemy of Self-Discovery

Life's earthquakes expose our foundations. Post-crisis periods—whether divorce, job loss, or health scares—become laboratories for reinvention when approached with curiosity rather than fear. Start with morning pages: three handwritten stream-of-consciousness pages upon waking. This practice, borrowed from artists, surfaces subconscious thoughts and patterns over time.

Personality assessments like the Enneagram or StrengthsFinder provide frameworks for understanding innate tendencies. Are you a perfectionist needing self-compassion? A peacemaker who avoids conflict? These insights become superpowers when consciously directed rather than unconsciously expressed.

Skill-Building as Self-Reinvention

Neurological research confirms learning new skills in adulthood builds cognitive reserve—a buffer against aging and adversity. Choose abilities that combine practicality and passion. Always loved cooking? Master knife skills through YouTube tutorials, then progress to sous vide. Tech-curious? Free coding bootcamps like freeCodeCamp open digital doors.

Language learning offers dual benefits: practical communication and proven dementia risk reduction. Apps like Duolingo gamify the process, while platforms like iTalki connect you with native speakers. For deeper immersion, plan a future trip where you'll use the language—accountability turbocharges motivation.

The Resilience Toolkit

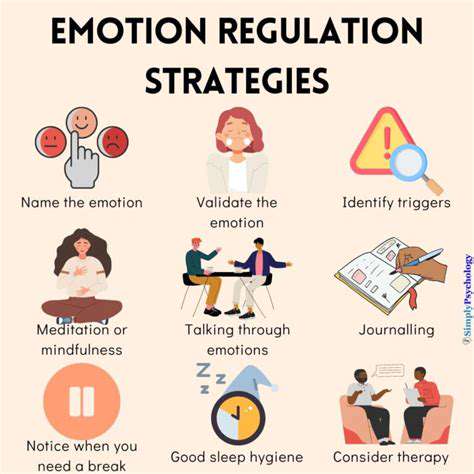

Build emotional shock absorbers through daily micro-practices. The 5-4-3-2-1 grounding technique (identify 5 sights, 4 touches, 3 sounds, 2 smells, 1 taste) short-circuits anxiety spirals. Progressive muscle relaxation—systematically tensing/releasing muscle groups—releases physical stress stores.

Cultivate a growth playlist—songs that instantly uplift or focus you. Create a physical resilience box with tactile anchors: a smooth stone from a meaningful hike, a loved one's handwritten note, essential oils for quick mood shifts. These tools become lifelines during turbulent moments.

Community as Catalyst

Transformation flourishes in community. Seek brain trust groups—small circles meeting regularly to share goals and accountability. Platforms like Meetup host everything from writing critique groups to hiking clubs. For niche interests, Facebook Groups or Discord channels offer global connections.

Reverse mentoring—learning digital skills from Gen Z coworkers while sharing professional wisdom—creates intergenerational bridges. Volunteering at animal shelters or food banks provides perspective while expanding social networks. Remember: the best networks aren't just professional contacts but diverse relationships enriching all life dimensions.

Designing Your Environment for Success

Willpower is overrated; environmental design is everything. Make desired behaviors effortless and undesired ones difficult. Want to read more? Place books in every room with enticing covers facing outward. Reduce screen time? Charge phones outside bedrooms and install website blockers during work hours.

Habit stacking—pairing new routines with established ones—creates sticky behavior change. After brushing teeth (existing habit), do two minutes of balance exercises (new habit). Over time, these micro-changes compound into transformed identities—you become someone who values fitness rather than someone forcing workouts.

The Long Game

Personal growth isn't about overnight transformations but gradual evolution—like a sapling becoming an oak. Keep a win journal noting daily progress, however small. Did you choose water over soda? Pause before reacting angrily? These victories accumulate into character.

Schedule quarterly life audits—weekend retreats reviewing goals, habits, and relationships. What's working? What needs pruning? Course-correct while staying true to your north star. Remember: the goal isn't perfection but consistent forward motion, one intentional step at a time.