Expert Advice on Divorce Agreement Drafting

Property Division in Divorce: A Comprehensive Overview

When couples decide to part ways, one of the most challenging aspects they face is dividing what they've built together. The process of splitting assets and debts requires careful consideration of numerous factors to achieve a balanced outcome. Every penny earned and every sacrifice made during the marriage carries weight in these negotiations. Courts examine bank statements, property deeds, and retirement accounts with meticulous attention to detail.

States approach this process differently - some like California enforce strict 50/50 splits, while others like New York consider what's truly fair given the circumstances. The difference between these approaches can mean gaining or losing thousands of dollars in assets. That's why consulting with a local family law specialist becomes not just helpful but essential when navigating these waters.

Factors Influencing Property Division

Judges examine multiple dimensions when dividing marital property. They consider how long you've been married - a two-year marriage versus a twenty-year marriage will be treated very differently. They'll evaluate whether one spouse put their career on hold to raise children or support the other's professional growth. These non-financial contributions carry just as much weight as monetary ones in many courtrooms.

The current financial landscape matters too. If one spouse earns significantly more or has better future earning potential, that will influence the division. Courts aim to prevent either party from facing financial ruin post-divorce while recognizing each person's ability to rebuild their life.

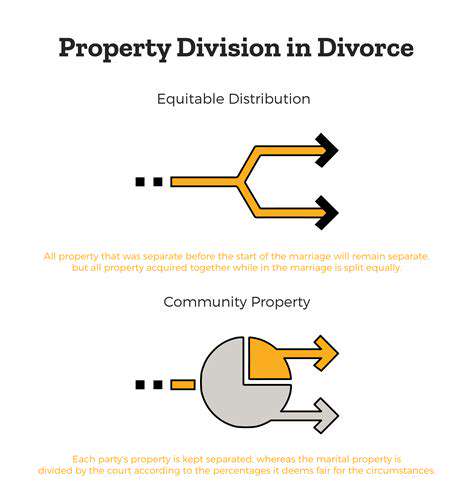

Equitable Distribution vs. Community Property

These two legal frameworks create entirely different landscapes for divorce settlements. Community property states operate on the principle that everything acquired during marriage belongs equally to both partners. Equitable distribution states take a more nuanced approach, considering what's truly fair rather than mathematically equal. Living in one type of state versus another could determine whether you keep the family home or have to sell it.

The distinction becomes particularly important with complex assets like businesses, stock options, or intellectual property. Some states might split the current value, while others consider future growth potential. This complexity underscores why personalized legal advice proves invaluable during divorce proceedings.

Protecting Your Interests During Property Division

Divorce can cloud judgment when emotions run high. That's why having a clear-eyed advocate becomes crucial. A seasoned divorce attorney does more than file paperwork - they help you see beyond the immediate emotions to the long-term financial implications. They'll ensure hidden assets don't disappear and that you receive proper valuation of complex holdings.

Start gathering documents early - tax returns, mortgage statements, investment portfolios. Create an inventory of everything from the silverware to the summer home. This preparation puts you in the strongest position when negotiations begin. Remember, knowledge is power when dividing your marital estate.

Empathy is often defined as the ability to understand and share the feelings of another person. This fundamental human skill enables us to connect on a deeper level and fosters genuine relationships. Without empathy, our interactions may be superficial and lacking in meaning, leading to emotional isolation.

Spousal Support (Alimony): Navigating the Financial Implications

Understanding Spousal Support

Spousal support serves as a financial bridge for spouses who sacrificed earning potential during marriage. It recognizes that divorce shouldn't leave one partner destitute after years of shared life. The calculations involve more than simple math - they reflect the economic realities created by the marriage itself.

Courts examine how the marriage affected each person's career trajectory. Did one spouse forego promotions to relocate for the other's job? Stay home with children? These factors shape support decisions as much as current income statements do.

Types of Spousal Support

Support arrangements come in different forms to address various situations. Temporary support maintains financial stability during divorce proceedings - think of it as keeping the lights on while paperwork processes. Rehabilitative support helps a spouse gain skills or education to reenter the workforce after years away.

Permanent support, increasingly rare, might apply in long marriages where one spouse never developed earning capacity. Even permanent orders often include review dates, recognizing that circumstances evolve over time.

Factors Affecting Spousal Support Decisions

The marriage duration plays a pivotal role - short marriages rarely warrant extensive support. Courts also examine earning potential, not just current income. A spouse with a medical degree choosing not to work will be treated differently than one with limited education struggling to find employment.

Lifestyle matters too. If you vacationed in Europe annually, the court won't expect the lower-earning spouse to suddenly live on rice and beans. The goal is maintaining reasonable continuity, not creating identical households.

Legal Representation and Advocacy

Alimony negotiations require skilled navigation. An experienced attorney understands how local judges interpret the guidelines and what arguments prove most persuasive. They'll help you present your financial story in the most compelling light, whether you're seeking or paying support.

Bring pay stubs, living expense breakdowns, and career trajectory documents to your consultation. The more complete your financial picture, the better your attorney can strategize for optimal outcomes.

Modifying or Terminating Spousal Support

Life changes, and so can support orders. Significant income shifts, remarriage, or retirement may justify modifications. The key is acting promptly when circumstances change - delays can mean losing rights to adjustments.

Document everything if seeking modification. New job offers, medical diagnoses, or unexpected windfalls all require proper paper trails. Your attorney can guide you through the petition process to ensure the court has all relevant information.

Read more about Expert Advice on Divorce Agreement Drafting

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases