Financial Planning After Divorce for Seniors

For seniors, it may also be wise to consider incorporating a healthcare contingency fund into your budget. According to the Bureau of Labor Statistics, healthcare costs can be a significant burden; thus, preparing financially for them is crucial.

Another practical suggestion is to revisit and adjust your budget on a quarterly basis. Life circumstances, such as fluctuating expenses or unexpected income, may necessitate changes to your original plan.

Utilizing Financial Tools and Resources

Several tools and resources are available to assist in effective budgeting following a divorce. Online budgeting software or spreadsheets can help you keep a real-time view of your finances. They allow you to categorize expenses and analyze spending patterns.

Additionally, consider reaching out to a financial advisor who specializes in divorce settlements. Their expertise can help you optimize your budget according to your new financial reality and tailor strategies that fit your long-term goals.

Be sure to tap into community resources designed for seniors. Many organizations offer free financial planning workshops, and local agencies can provide additional support tailored to your needs.

Monitoring and Adjusting Your Budget

Budgeting is not a one-time task; it's an ongoing process that requires regular monitoring and adjustment. Review your budget monthly to track your progress and identify any areas where you may need to cut down. This proactive approach can help you avoid financial strains before they escalate.

Another important aspect is the readiness to adapt to changes in your financial situation. If a source of income diminishes or an expense increases, reassess and reallocate your budget priorities to maintain a healthy financial balance.

Finally, document your journey. Keeping a record of your budgeting efforts not only provides insights into your spending habits but can also motivate you to stick to your financial goals over the long run.

Seeking Professional Guidance

Understanding Your Financial Situation

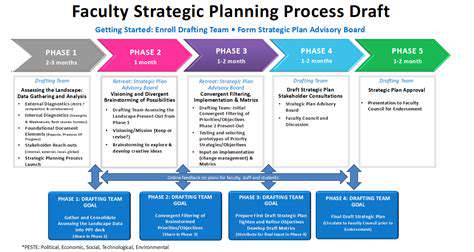

After a divorce, it’s crucial to assess your financial state comprehensively. Start by gathering all financial documents, including bank statements, credit card statements, tax returns, and property deeds. This information will help you understand assets, liabilities, and overall net worth.

Use this information to create a comprehensive budget that reflects your post-divorce lifestyle. Consider expenses such as housing, healthcare, and any potential alimony or child support payments. This budget will serve as a foundation for your financial planning and help identify areas where you can cut costs.

Consulting a Financial Advisor

Engaging with a certified financial planner can significantly enhance your post-divorce financial strategy. Look for professionals who specialize in divorce financial planning, as they understand the nuances involved in such transitions. According to the Financial Planning Association, individuals working with advisors often report higher levels of financial confidence and stability.

A financial advisor can assist in creating a solid retirement strategy, integrating factors such as Social Security, pension entitlements, and investment portfolios, all tailored to meet your unique situation. These tailored strategies can mitigate risks associated with economic fluctuations.

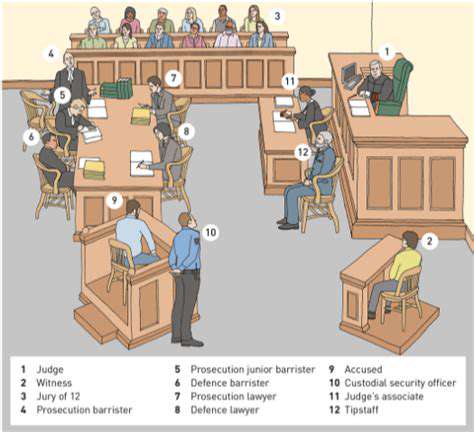

Revising Estate Plans

It’s important to revisit and revise your estate planning documents post-divorce to reflect your current wishes. This may include updating wills, trusts, and beneficiary designations. Failing to update these can lead to unintended consequences, such as an ex-spouse inheriting assets contrary to your intentions.

Consider seeking legal advice to ensure the documents align with state laws and reflect your new circumstances. For example, if you previously designated your spouse as power of attorney, you'll want to change that to someone else you trust. This proactive approach helps safeguard your interests and those of your loved ones.

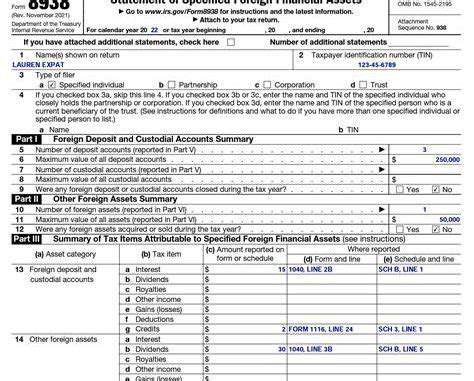

Understanding Tax Implications

Divorce can have significant tax implications that are often overlooked in financial planning. For instance, filing status may change from joint to single, influencing your tax bracket. It's vital to factor in these changes when planning your finances for the upcoming tax year.

Moreover, be aware of how asset division can affect your taxes. For instance, selling a family home may lead to capital gains tax liability. Consulting a tax professional can help you navigate these complexities effectively and avoid surprises come tax season.

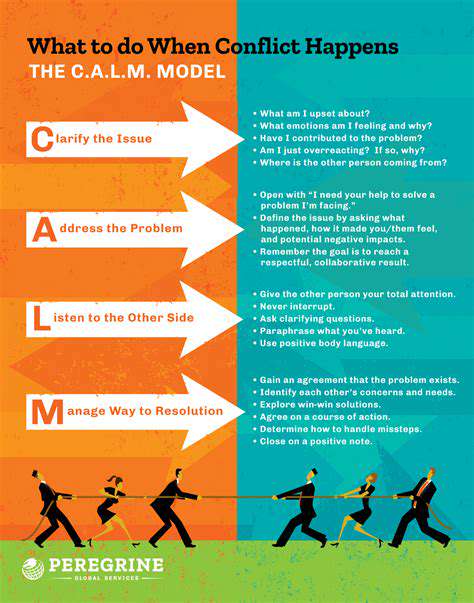

Building a Support Network

Creating a solid support network is essential for navigating your post-divorce financial journey successfully. Connect with local or online support groups that can provide emotional support, share pragmatic advice, and help you stay accountable to your financial goals.

Additionally, consider involving family members or friends who have gone through a similar experience. Their insights can offer reassurance and practical tips that may simplify your financial decisions. Having a network can also provide motivation as you adjust to your new financial reality.