Best Practices for Divorce Legal Agreements

Every love story thrives on those unscripted, genuine moments that often go unnoticed - the stolen glances, the quiet laughter, the way fingers unconsciously intertwine. These unfiltered interactions form the emotional backbone of any relationship. They reveal more about a couple's bond than any posed photograph ever could, showcasing the unique rhythm of their connection that's developed over time.

Financial Settlement: Equitable Division of Assets and Liabilities

Understanding the Importance of Equitable Division

A fair and equitable division of assets and liabilities is crucial in any financial settlement. This process aims to ensure that both parties involved are treated justly and receive a proportionate share of the accumulated wealth and debts. Failing to achieve equitable division can lead to resentment, disputes, and potentially protracted legal battles. Understanding the inherent value of each asset and liability is paramount to creating a solid foundation for a lasting settlement.

Identifying and Valuing Assets

Accurate identification and valuation of assets are fundamental to a fair settlement. This includes tangible assets like real estate, vehicles, and personal belongings, as well as intangible assets such as retirement accounts, investment portfolios, and intellectual property. Professional valuations, where necessary, should be conducted by qualified appraisers to ensure objectivity and accuracy in the assessment of each asset's worth.

Precisely documenting each asset, outlining its ownership history, and determining its current market value is essential for a transparent and comprehensive settlement.

Addressing Liabilities and Debts

Equitable division also encompasses a thorough review and resolution of all outstanding liabilities and debts. This includes mortgages, loans, credit card balances, and any other financial obligations. Dividing these responsibilities fairly requires careful consideration of the terms of each debt and the ability of each party to manage their portion.

Negotiation and Mediation Strategies

Open and honest communication is key to successful negotiation. Parties involved in a financial settlement should strive to understand each other's needs and concerns. Negotiation techniques, such as compromise and mediation, can often help parties reach a mutually agreeable resolution. Mediation, in particular, provides a neutral forum for discussion and can facilitate communication and cooperation to achieve an equitable settlement.

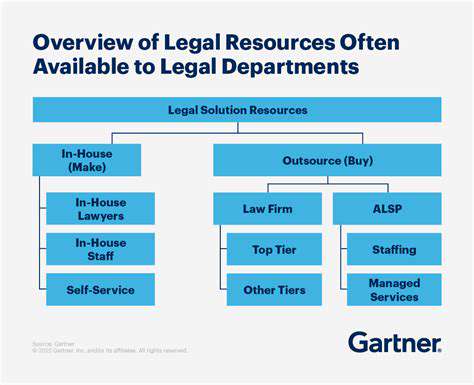

Legal Considerations and Documentation

Navigating the complexities of legal requirements during financial settlement is vital. Consulting with legal professionals is recommended to ensure compliance with relevant laws and regulations. Thorough documentation of all agreements, valuations, and settlements is essential to protect the interests of all parties involved and to prevent future disputes.

Tax Implications and Planning

Understanding the potential tax implications of a financial settlement is crucial. Proper tax planning and consultation with a qualified tax advisor are essential for navigating the tax consequences of asset division and debt allocation. This planning will minimize tax burdens and ensure compliance with all relevant tax laws and regulations.

Review and Approval of the Settlement Agreement

A comprehensive and meticulous review of the finalized settlement agreement is paramount. Both parties should carefully scrutinize the agreement to ensure that all aspects of the settlement are accurately reflected and that their interests are protected. Seeking legal counsel to review the agreement before signing is highly recommended to avoid future misunderstandings and disputes.

Enforcing and Modifying the Agreement: Important Legal Considerations

Enforcing the Agreement

Enforcing a contract, whether it's a simple purchase agreement or a complex business deal, often requires navigating a complex legal landscape. Understanding the specific clauses within the agreement, the jurisdiction's laws governing contracts, and potential remedies for breach are crucial for successful enforcement. This involves careful consideration of the evidence supporting the agreement's terms and potentially involving legal counsel to ensure a strong case for enforcement.

The process of enforcement can vary depending on the nature of the agreement and the jurisdiction. Sometimes, a simple letter demanding performance or a notice of default might suffice, while other situations necessitate formal legal action, such as filing a lawsuit or initiating arbitration proceedings. Knowing the available avenues for enforcement is essential for maximizing the chances of a favorable outcome.

Modifying the Agreement

Modifying an existing agreement necessitates a clear understanding of the original contract and the specific provisions regarding modifications. Often, these provisions outline the required procedures for amendment, including mutual consent, consideration (something of value exchanged), or adherence to specific formalities, like written documentation or notarization. Failure to adhere to these stipulations could invalidate the modification attempt.

Legal Capacity of Parties

Before enforcing or modifying any agreement, verifying the legal capacity of all parties involved is paramount. This entails confirming that all parties have the necessary legal authority to enter into and modify the agreement. Minors, individuals under guardianship, or those lacking mental capacity may not have the legal standing to enter into a binding agreement. This crucial step prevents future disputes and ensures the agreement's validity.

Statute of Limitations

The statute of limitations dictates the timeframe within which legal action can be taken to enforce or challenge an agreement. Understanding these limitations is critical for both parties, as failing to initiate action within the prescribed period could result in the loss of legal recourse. The specific timeframes vary significantly based on the type of agreement and the jurisdiction.

Consideration and Value Exchange

A key element in contract law is the concept of consideration. This refers to something of value exchanged between the parties. Without sufficient consideration, an agreement may be deemed unenforceable. Determining whether the consideration offered adequately reflects the value of the obligations undertaken is crucial for ensuring the agreement’s validity. Inadequate consideration can render the agreement void or voidable, especially in situations involving disproportionate exchange.

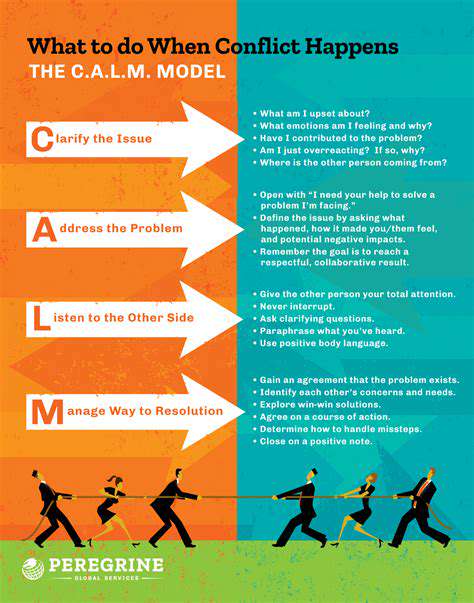

Dispute Resolution Mechanisms

Agreements often include provisions outlining the procedures for resolving disputes that may arise. These provisions can range from mediation and arbitration to litigation. Understanding these mechanisms and their potential implications can significantly impact the handling of disagreements. Choosing the appropriate dispute resolution method can streamline the process, potentially reducing costs and time associated with resolving conflicts.

Read more about Best Practices for Divorce Legal Agreements

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases