best legal advice for divorce settlements

Child Custody and Support Considerations

Determining Child Custody Arrangements

Navigating child custody arrangements during a divorce can be emotionally challenging, and the best approach is often determined by a careful consideration of the child's best interests. This involves evaluating factors such as the child's age, developmental needs, and established relationships. Legal professionals specializing in family law can guide parents through the process of creating a custody plan that prioritizes the child's well-being and minimizes potential disruptions. Thorough documentation of each parent's involvement in the child's life, including school attendance, extracurricular activities, and medical appointments, is crucial in establishing a custody schedule that promotes a healthy and stable environment for the child.

Different custody models exist, including sole custody, joint custody, and split custody, each with its own set of implications. Understanding the nuances of each arrangement and how they might impact the child's routine is essential. Legal counsel can advise on the potential benefits and drawbacks of each model, helping parents make informed decisions that align with the child's best interests. Factors such as the distance between parents' residences, the child's preference (depending on age and maturity), and the ability of each parent to provide a nurturing and stable environment are also crucial considerations when determining the most suitable custody arrangement.

Establishing Child Support Obligations

Child support is a critical aspect of divorce settlements, designed to ensure the financial well-being of the child. The calculation of child support payments typically considers the parents' incomes, the number of children, and the time each parent spends with the child. Variations in income, such as significant discrepancies in earning potential, or if one parent is self-employed, can have a significant impact on the support calculations. Accurate financial disclosure is paramount for establishing a fair and equitable child support arrangement. The goal is to provide a stable financial base for the child's needs, including housing, food, education, and healthcare.

Understanding the legal framework surrounding child support is crucial for both parents. This involves becoming familiar with the relevant laws and regulations in the jurisdiction where the divorce is taking place. Knowing the specific guidelines and factors considered in support calculations will empower parents to make informed decisions about their financial obligations. Legal representation can provide vital support in navigating the complexities of child support calculations and ensuring that the established support amount accurately reflects the child's needs. This ensures that the financial needs of the child are met without undue hardship on either parent.

Spousal Support (Alimony) and its Implications

Understanding Spousal Support

Spousal support, often referred to as alimony, is a court-ordered payment made by one spouse to the other after a divorce. It's designed to provide financial assistance to the spouse who may have been financially dependent during the marriage, and who may need time to adjust to a single-income lifestyle. The specific amount, duration, and form of spousal support are determined by the court and are influenced by a variety of factors, including the length of the marriage, the earning capacity of each spouse, and the contributions each spouse made to the marriage, both financially and otherwise. Understanding these factors is crucial when navigating the complexities of a divorce.

Different types of spousal support exist, each with varying implications. For example, temporary spousal support can be ordered during the divorce proceedings, while permanent spousal support is often granted in marriages of longer duration. These differences can significantly impact the financial future of both parties involved. It's essential to understand the specifics of each type of support and how they apply in individual circumstances.

Factors Affecting Spousal Support Decisions

Numerous factors influence a judge's decision regarding spousal support. These include the length of the marriage, the age and health of each spouse, the earning capacity of each spouse, and the contributions each spouse made to the marriage. For example, a spouse who stayed home to raise children might be entitled to support, while a spouse who has built a successful career might be less likely to receive support. These factors are meticulously considered to ensure a fair and equitable outcome.

The standard of living established during the marriage is also a significant consideration. A spouse accustomed to a higher standard of living might be awarded support to maintain that lifestyle for a period, while a spouse accustomed to a lower standard of living might not be awarded the same level of support. Understanding these nuances is critical for both parties involved in a divorce.

The Role of Earning Capacity in Support Determinations

A significant factor in determining spousal support is the earning capacity of each spouse. Courts aim to ensure that the recipient spouse is not left in a financially disadvantaged position compared to their pre-divorce circumstances. This assessment often considers current job skills, education, and training opportunities available to the recipient spouse. A spouse with a proven history of high earning potential and the ability to secure employment in a comparable field is unlikely to receive the same level of support as a spouse with limited employment history.

Duration and Termination of Spousal Support

The duration of spousal support varies greatly depending on the circumstances of the case. Some jurisdictions have guidelines for determining the duration of support based on factors like the length of the marriage. In other cases, the court may impose support for a specific period, or until the recipient spouse remarries or becomes self-sufficient. Understanding the specific legal standards in your jurisdiction is critical in understanding the potential duration of support.

Tax Implications of Spousal Support

It's essential to be aware of the tax implications associated with spousal support. The paying spouse typically deducts the support payments from their taxes, while the recipient spouse includes the payments in their taxable income. Understanding these tax implications is crucial for both parties to accurately account for these financial obligations and plan for their future financial well-being. This is an area where professional financial advice can be crucial.

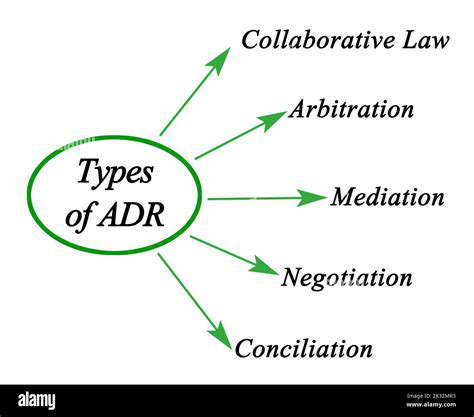

Legal Representation and Negotiation

Navigating the complexities of spousal support can be challenging, and seeking legal representation is highly recommended. A skilled attorney can advocate for your best interests, gather evidence, and negotiate a fair settlement. In many cases, negotiation is possible, and engaging in a collaborative process can lead to a more amicable resolution. Legal counsel can guide you through the process, ensuring that your rights are protected and your financial future is considered.

Read more about best legal advice for divorce settlements

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases