divorce breakup recovery strategies

Setting Boundaries and Prioritizing Your Well-being: Creating Healthy Habits

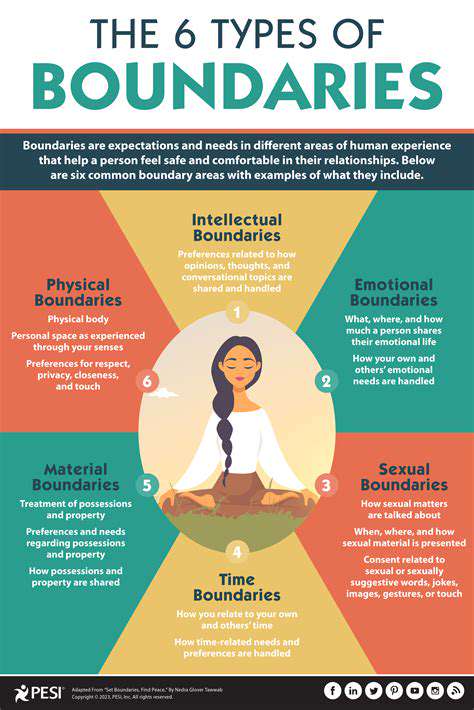

Defining Your Limits

Setting boundaries is crucial for maintaining a healthy work-life balance and preventing burnout. It involves clearly identifying your limits and communicating them to others. This includes recognizing your physical and emotional capacities and establishing clear expectations for how you will manage your time and energy. Understanding your own needs is paramount to setting effective boundaries. Knowing when to say no to additional tasks or commitments that exceed your capacity is a vital step in this process.

This process also involves recognizing your personal values and aligning your actions with them. By understanding your priorities, you can better allocate your time and energy towards activities that truly matter to you. Setting boundaries is not about being selfish, but about prioritizing your well-being and ensuring that you can effectively contribute to your responsibilities without sacrificing your overall health and happiness.

Prioritizing Tasks Effectively

Prioritizing tasks is a key skill for managing your workload and achieving your goals. It's about identifying the most important and urgent tasks and focusing your energy on completing them first. This often involves using tools like to-do lists, calendars, or project management software to track progress and ensure that tasks are completed in a timely manner. Effective prioritization strategies allow you to allocate your time and resources in a way that aligns with your goals and maximizes productivity.

Prioritization is a dynamic process that requires continuous evaluation and adjustment. As circumstances change, priorities might shift. Adaptability is key to effectively managing your workload and ensuring you're always working towards the most critical goals.

Recognizing Time Wasters

Identifying and eliminating time wasters is essential for optimizing productivity. These can include distractions like social media, excessive email checking, or unproductive meetings. Recognizing these activities allows you to allocate more time and energy to high-priority tasks. Time management involves identifying and eliminating these time sinks to maximize effectiveness and efficiency.

Understanding what activities drain your time and energy is an important first step. Often, these distractions are subtle and require conscious awareness. By documenting your time use over a period, you can begin to see patterns and identify specific activities that contribute to wasted time.

Communicating Boundaries Effectively

Communicating your boundaries clearly and confidently is vital for maintaining healthy relationships and preventing misunderstandings. This involves expressing your limits in a respectful and assertive manner, without feeling apologetic or defensive. Clear communication is essential for others to understand your needs and for you to maintain your personal boundaries.

Practice active listening when others communicate with you about their needs. This will help both of you understand each other better. It will also help to create a more respectful and productive environment.

Establishing Realistic Goals

Setting realistic and achievable goals is essential for maintaining motivation and preventing feelings of overwhelm. Goals should be specific, measurable, attainable, relevant, and time-bound (SMART). Breaking down large goals into smaller, more manageable steps can make the process less daunting and more achievable. By using these techniques to achieve your goals, you can stay focused on the desired outcome.

Managing Stress and Burnout

Effective time management and boundary setting are crucial for preventing stress and burnout. Prioritizing self-care, including adequate sleep, exercise, and healthy eating, is essential for maintaining well-being. Engaging in stress-reducing activities, such as meditation or mindfulness, can help manage stress levels and promote overall well-being. Maintaining a healthy work-life balance is also vital for preventing burnout.

Regular breaks and downtime are essential to prevent burnout and maintain focus. Scheduling specific time for relaxation and rejuvenation can significantly impact your overall well-being and productivity.

Read more about divorce breakup recovery strategies

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases