how to manage divorce financial challenges

Seeking Professional Guidance

Understanding the Financial Landscape of Divorce

Navigating the financial complexities of divorce can feel overwhelming, but understanding the initial landscape is crucial. This involves assessing all assets, debts, and income streams, both yours and your spouse's. A thorough understanding of financial documents, such as bank statements, investment records, and tax returns, is essential for accurately evaluating your current financial situation and anticipating potential future challenges.

Divorce can significantly alter your financial outlook, impacting everything from your monthly budget to your long-term financial security. Knowing the potential implications, such as changes in housing expenses, child support, and alimony payments, will help you proactively address these issues.

Developing a Comprehensive Financial Plan

Creating a detailed financial plan is critical for managing divorce-related financial challenges effectively. This plan should include a realistic budget that accounts for all anticipated expenses, including those associated with legal fees, potential alimony or child support payments, and your new living arrangements. This budget should be reviewed and adjusted as needed throughout the divorce process.

This plan needs to incorporate short-term and long-term financial goals, focusing on your immediate needs and future financial stability. Strategies for managing debt, saving for the future, and building an emergency fund should be outlined.

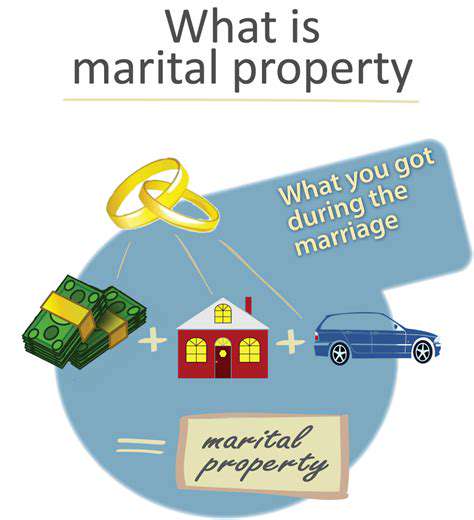

Addressing Debt and Assets Division

Dividing assets and liabilities is a significant aspect of divorce settlement. This often involves negotiating the fair distribution of marital property, including real estate, bank accounts, retirement funds, and other investments. Understanding the legal framework for asset division in your jurisdiction is essential.

Thorough documentation of all assets and debts is crucial. This allows for a clear and transparent division process, minimizing potential disputes and ensuring a fair outcome for both parties. Seeking professional advice from a financial advisor or attorney is highly recommended to navigate this complex process.

Managing Income and Expenses During Divorce

Divorce often results in a significant shift in income and expense patterns. Understanding how these changes will impact your budget is vital. Creating a new budget that reflects your post-divorce income and expenses is paramount to financial stability. This may involve finding new employment or adjusting your spending habits to align with your reduced income.

Protecting Your Financial Future

Divorce can create vulnerabilities in your financial future, particularly in the absence of a well-defined plan. Securing your financial future involves strategies for building credit, investing wisely, and creating a strong financial foundation. This may include reviewing and updating your insurance policies, creating a will, or potentially exploring new investment opportunities.

Protecting your financial future involves establishing new financial goals, such as saving for retirement or a down payment on a new home. It's important to consider the long-term consequences of your financial decisions during and after the divorce process.

Seeking Professional Help

Navigating the financial intricacies of divorce can be daunting, and seeking professional guidance is highly recommended. A qualified financial advisor can provide valuable insights and support in developing a sound financial strategy. They can help you assess your current financial situation, develop a budget, and create a plan for managing debt and assets.

Legal counsel is also crucial during this process. An experienced attorney can represent your interests, ensuring that your rights and financial needs are protected throughout the divorce proceedings. Don't hesitate to reach out to professionals for support and guidance.

Read more about how to manage divorce financial challenges

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

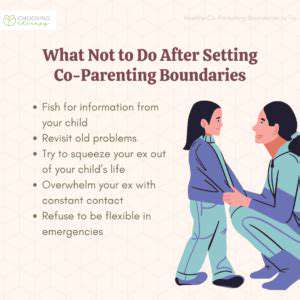

- best co parenting solutions for divorce cases