how to negotiate fair divorce asset division

Understanding the Core Principles of Fair Division

Fair division in a divorce context necessitates a nuanced understanding of what constitutes fairness, moving beyond simplistic notions of equal division. It's crucial to consider not only the tangible assets like property and bank accounts but also intangible contributions, such as career sacrifices, homemaking responsibilities, and the emotional labor invested in the relationship. This evaluation should be undertaken with sensitivity and an awareness of the potential long-term impact on both parties' financial well-being. A truly fair outcome requires thoughtful consideration of each party's individual circumstances and needs.

Further complicating the matter is the recognition that fair isn't universally defined. What one party perceives as fair may differ significantly from the other. This necessitates a structured and impartial process to determine a division that, while not perfectly equitable in every detail, acknowledges the legitimate needs and contributions of both parties. Compromise and willingness to consider alternative solutions are essential in achieving a resolution that feels just for both individuals involved in the process.

Navigating Complex Asset Divisions

Dividing assets in a divorce can become exceptionally intricate when dealing with complex assets such as businesses, investments, or retirement accounts. These situations demand meticulous evaluation, potentially requiring the expertise of financial advisors, appraisers, or even legal professionals specializing in complex asset division. A critical component of this process involves determining the current market value of each asset and understanding its potential future value, especially in the case of developing businesses or investments.

Moreover, the division of assets should take into account each party's future needs and circumstances. Factors such as anticipated expenses, future income potential, and any existing debts need careful consideration. A thorough evaluation of each party's financial situation is imperative to ensuring that the division is not only fair but also sustainable in the long run, providing each party with a solid foundation for their future.

The process of dividing retirement accounts often requires specialized knowledge and adherence to specific legal guidelines. Understanding the tax implications of various division options is critical. Failure to address these complexities could result in significant tax liabilities or financial disadvantages for one or both parties in the long term.

Considering the potential impacts of spousal support (alimony) and child support, as well as any pre-nuptial agreements, is crucial in this comprehensive assessment.

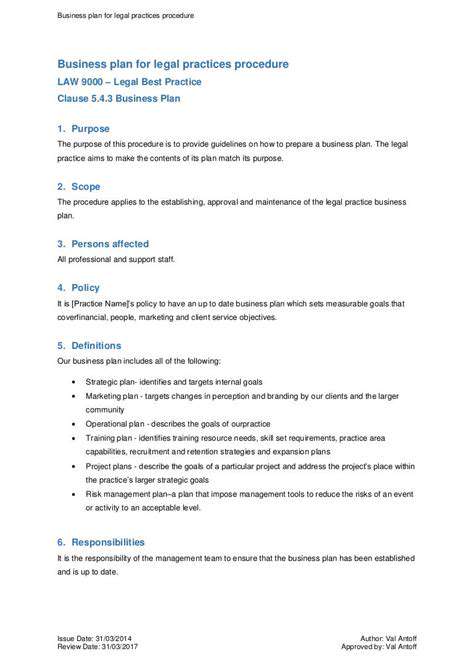

Detailed documentation of each step in the division process is vital to ensure transparency and maintain a clear record for future reference.

Identifying and Valuing Marital Assets: A Crucial Step

Identifying Potential Issues in a Marriage

Recognizing warning signs in a marriage is crucial for maintaining a healthy and fulfilling relationship. These signs can manifest in various ways, from subtle communication breakdowns to more overt displays of conflict. Understanding these early indicators can help couples address issues before they escalate into larger problems. Identifying patterns in communication styles, such as defensiveness or a lack of empathy, can be a key indicator of underlying issues.

Often, the initial stages of marital problems involve a gradual erosion of intimacy and connection. This can manifest as decreased physical affection, a lack of shared interests, and a feeling of emotional distance between partners. It's essential to acknowledge these shifts early on and engage in open communication to address the root causes.

The Importance of Open Communication

Honest and open communication is the cornerstone of any successful marriage. This involves actively listening to your partner's perspective, even when you disagree. Active listening involves more than just hearing the words; it's about understanding the underlying emotions and needs behind the message. Effective communication also involves expressing your own thoughts and feelings respectfully and constructively.

Financial Considerations and Marital Stability

Financial pressures can significantly impact a marriage. Disagreements about spending habits, debt management, and future financial goals can create tension and strain a relationship. Open and honest financial discussions are essential for building trust and ensuring a shared understanding of financial responsibilities.

Creating a joint budget and establishing clear financial goals can help mitigate these pressures. Establishing a clear understanding of each partner's financial needs and expectations is crucial.

Understanding the Role of Individual Needs and Expectations

Each individual brings unique needs and expectations to a marriage. Recognizing and understanding these differences is essential for creating a supportive and fulfilling relationship. It's critical to have open conversations about individual expectations and to find ways to accommodate and meet those needs within the context of the relationship. This may involve compromising on certain aspects and developing strategies for mutual support and understanding.

Identifying and addressing individual needs, including emotional, physical, and social needs, can strengthen the bond between partners and create a more harmonious relationship dynamic.

Assessing the Impact of External Pressures on the Relationship

External pressures, such as job stress, family issues, or health concerns, can significantly impact a marriage. Recognizing and addressing these external stressors is crucial for maintaining a healthy relationship. It's important to acknowledge the impact of these pressures on both individuals and to support each other through challenging times.

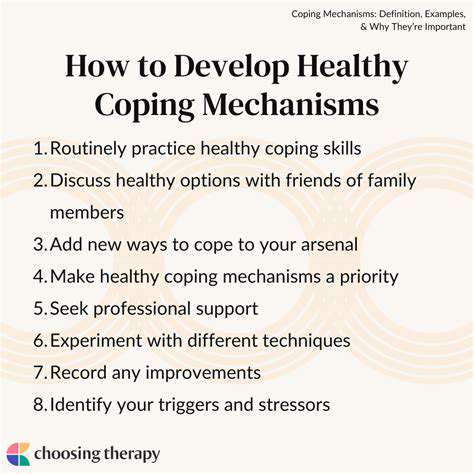

Finding healthy ways to cope with external pressures as a couple is vital to maintaining marital stability and well-being. This might include seeking professional help or developing strategies for managing stress and conflict effectively.

Strategies for Negotiating Asset Division: A Collaborative Approach

Understanding Your Assets

A crucial first step in negotiating asset division is a thorough understanding of your own financial situation. This includes not only tangible assets like houses and cars, but also intangible assets like retirement accounts, investment portfolios, and business interests. Carefully document all assets, including their current value, any associated debts or liabilities, and any relevant legal documents. Understanding the full scope of your assets is essential to building a strong negotiating position and avoiding blind spots during the process.

Knowing the current market value of your assets is equally important. Researching comparable properties, consulting with financial advisors, and reviewing recent market trends can help you accurately assess the worth of your holdings. This empowers you to make informed decisions and avoid potential financial pitfalls during the negotiation process, leading to a more equitable and satisfactory outcome for both parties.

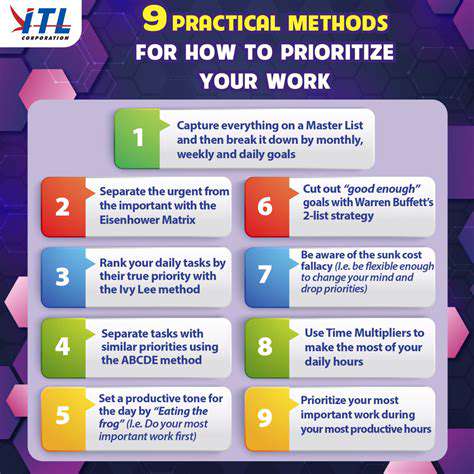

Defining Your Priorities

Before you even begin negotiating, clearly define your priorities. What assets are most important to you? Are you more concerned with preserving your retirement savings, maintaining a certain standard of living, or securing a specific property? Knowing your priorities will help you stay focused and avoid being swayed by emotional or external pressures during the negotiation process. A well-defined strategy is crucial to achieving a result that aligns with your financial goals and personal well-being.

Developing a Collaborative Strategy

Negotiating asset division doesn't have to be adversarial. A collaborative approach, focused on finding mutually beneficial solutions, can lead to a more amicable and sustainable outcome. This involves actively listening to the other party's concerns and interests, and working together to identify creative solutions that address everyone's needs. Open communication and a willingness to compromise are key to a successful and positive outcome for all involved.

Seeking Professional Guidance

Navigating the complexities of asset division can be challenging. Seeking guidance from experienced professionals, such as mediators, financial advisors, or lawyers, can significantly improve the process. These experts can provide valuable insights, help you understand your legal rights and obligations, and guide you through the negotiation process to ensure a fair and legally sound agreement. Leveraging professional expertise is often crucial for achieving a favorable resolution and preventing future disputes.

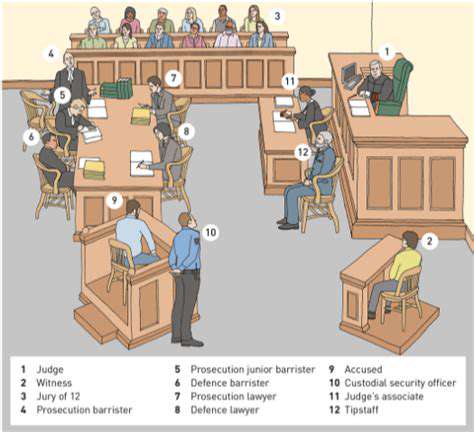

Utilizing Mediation and Alternative Dispute Resolution

Mediation offers a structured and confidential process for resolving disputes outside of court. A neutral third party mediator can help facilitate communication, identify common ground, and explore creative solutions. This can be significantly less costly and time-consuming than litigation, and it often leads to more sustainable agreements that are tailored to the specific needs of the parties involved. Exploring mediation as a first step can save time, money, and emotional energy in the long run.

Dealing with Complex Assets: Retirement Accounts and Businesses

Dealing with the complexities of Retiring Assets

Retiring assets, whether physical equipment, intellectual property, or financial instruments, often present unique challenges. Understanding the full scope of these assets' lifecycle, from initial acquisition to eventual disposal, is crucial for effective management. This involves careful consideration of potential liabilities and obligations associated with the asset's retirement. A thorough assessment must be conducted to mitigate any unforeseen risks and ensure a smooth transition.

Evaluating Asset Value and Depreciation

Accurate valuation of retiring assets is paramount. This process often involves a detailed review of historical records, market data, and expert opinions. Proper depreciation calculations are essential for financial reporting and tax purposes. Inaccurate assessments can lead to significant financial discrepancies and regulatory issues.

Considering the asset's current condition and its potential resale value is critical. This analysis should also account for any obsolescence or technological advancements that may impact its worth.

Legal and Regulatory Compliance

Retiring assets frequently necessitate navigating a complex web of legal and regulatory requirements. These regulations vary significantly depending on the type of asset and the jurisdiction in which it's located. Understanding and adhering to these requirements is crucial to avoid penalties and legal challenges. Thorough due diligence and consultation with legal and regulatory experts are essential.

Financial Implications of Retirement

The financial implications of retiring an asset can be substantial. It's imperative to consider the costs associated with decommissioning, disposal, or transfer of ownership, in addition to any potential tax implications or insurance requirements. Careful financial planning is essential for minimizing the financial impact of asset retirement. This includes estimating potential gains or losses resulting from the asset's disposal.

Environmental Considerations

Retiring assets often have environmental implications, particularly when dealing with hazardous materials or polluting processes. Strict adherence to environmental regulations during the retirement process is critical for protecting human health and the environment. This may involve proper disposal methods, remediation of contaminated sites, and compliance with environmental permits and licenses.

Stakeholder Communication and Management

Effective communication with all stakeholders is vital during the asset retirement process. This includes employees, customers, regulatory bodies, and the community. Clear and timely communication builds trust and minimizes potential disruptions. Transparent communication throughout the process is essential to managing expectations and mitigating potential conflicts.

Documentation and Record Keeping

Thorough documentation and record keeping are crucial for managing the retirement process. Maintaining detailed records of all steps, decisions, and communications is essential for audit trails and future reference. This comprehensive documentation can also be vital in dispute resolution or legal proceedings. Accurate records can also streamline future asset management procedures.

Read more about how to negotiate fair divorce asset division

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases