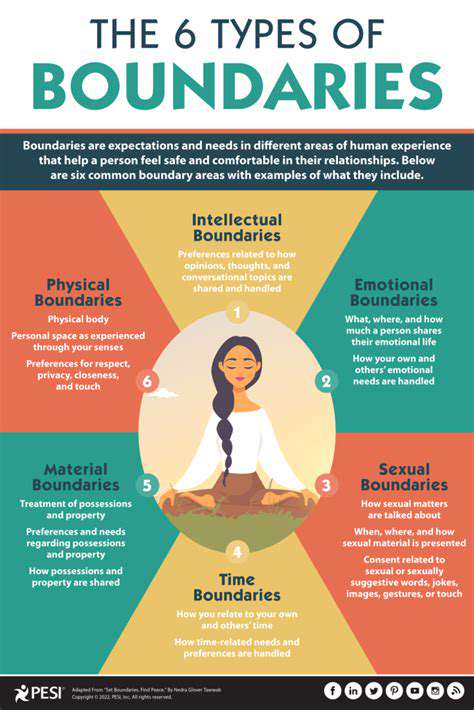

Welcome to our Divorce & Breakup Recovery Hub—a trusted resource dedicated to empowering individuals through life’s most challenging transitions. Our blog provides expert insights, practical tips, and actionable strategies on navigating divorce legalities, managing financial and emotional setbacks, and building effective co-parenting relationships. Whether you’re looking for advice on drafting custody agreements, overcoming breakup anxiety, or creating a supportive post-divorce environment, our comprehensive articles are designed to help you rebuild your confidence and create a fresh start. Join our community today and take the first step toward healing and renewal.

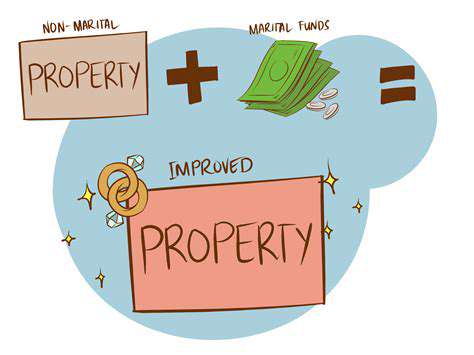

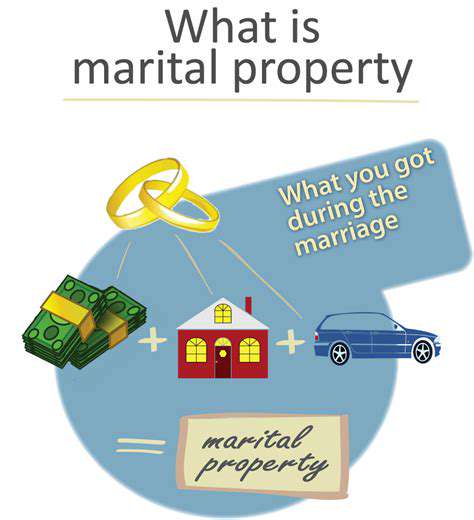

divorce property settlement guide for couples

Aug 01, 2025

how to create a stable post divorce environment

Aug 01, 2025

divorce legal consultation for asset division

Jul 30, 2025

practical guide to divorce legal settlements

Jul 30, 2025

divorce financial planning after separation guide

Jul 29, 2025

ex relationship tips for healthy communication

Jul 29, 2025

effective divorce settlement tips for couples

Jul 29, 2025

how to create a parenting plan after divorce

Jul 28, 2025

Hot Recommendations

- divorce legal consultation near me

- co parenting success after divorce

- preventing divorce cold violence methods

- co parenting advice for divorce families

- building resilience after divorce

- how to move forward confidently after divorce

- divorce recovery tips for single parents

- how to rebuild trust after divorce

- best divorce settlement resources online

- post divorce self improvement guide