Financial Planning After Divorce and Child Custody

In addition to basic categories, consider adding specific entries for discretionary spending. This could include expenses like children's activities or personal wellbeing. Being specific can prevent overspending in these areas, allowing you to enjoy life without financial stress. Finally, ensure to revisit these categories periodically to make adjustments as your financial situation or priorities change.

Adjusting and Monitoring Your Budget

Creating a budget is not a one-time task but rather an ongoing process. After establishing your budget, it is crucial to monitor your spending and adjust your categories as needed. Consider setting periodic reviews—monthly or quarterly—to evaluate your financial performance. Using software or spreadsheets can help visualize where your money is going relative to your set budget. This practice not only holds you accountable but also provides insights that may lead to smarter spending habits.

When monitoring, be sure to celebrate small victories like successfully sticking to a savings goal or reducing unnecessary expenses. Furthermore, remain flexible and open to change; life post-divorce can be unpredictable, and your financial plan should adapt accordingly. Adjustment is key, and recognizing what works for you will lead to long-term success in your financial planning.

Understanding Child Custody and Support Guidelines

Determining Child Custody Arrangements

Child custody arrangements typically vary based on the child's best interests, which is a primary consideration in custody disputes. The court often evaluates numerous factors such as the parents' living situations, the emotional bonds with the child, and the child's own preferences once they reach a significant age. Understanding these elements can assist parents in negotiating more amicable arrangements.

One common form of custody is joint custody, which allows both parents to be involved in decision-making and care. This is often viewed as beneficial because it provides emotional stability for the child by maintaining strong ties with both parents.

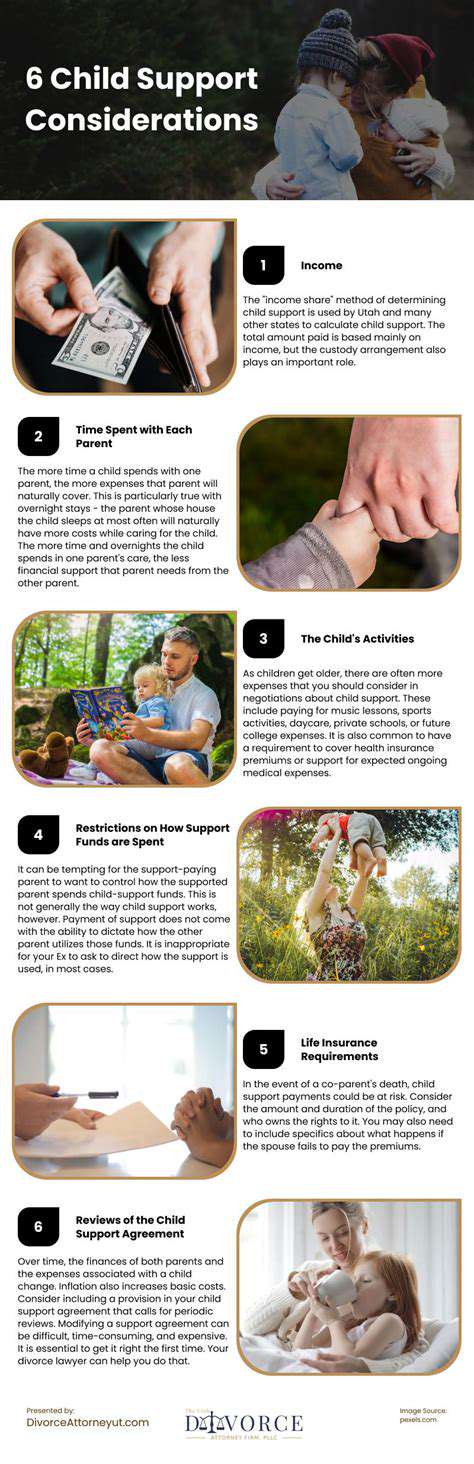

Types of Child Support Payments

Child support is generally categorized into two primary types: periodic payments and lump sum payments. Periodic payments are typically monthly and are calculated based on a formula that considers both parents' income, necessary living expenses, and the child's needs. This ensures a consistent support flow that can adapt to changing circumstances.

A lump sum payment might be appropriate in particular situations, particularly where one parent has more substantial assets or income. However, this arrangement must be carefully negotiated to guarantee that it comprehensively covers the child’s future needs.

Calculating Child Support Obligations

- Financial aspects include income, employment status, and living costs.

- State-specific guidelines determine baseline child support amounts.

- Consideration for healthcare, education, and extra-curricular activities may apply.

The calculation of child support obligations is frequently guided by state-specific guidelines, which take into account both parents’ incomes and the child's needs. In many instances, formulaic approaches help promote fairness and transparency, ensuring that neither parent is unduly burdened. Continuing education or healthcare needs may also influence the final determination.

Modifying Custody and Support Orders

Life is dynamic, and so are parenting situations. Modifications for both custody and support orders may occur due to significant changes, such as job loss or relocation. Courts generally require substantial evidence to justify any amendments, so it is crucial to document circumstances thoroughly.

Enlisting the help of a legal professional can streamline the process, making sure all procedural aspects are appropriately handled to achieve the desired outcome. This diligence can be particularly important in ensuring long-term stability for the child involved.

Navigating Legal Assistance for Custody Issues

When entering custody negotiations, hiring a specialized family law attorney can significantly influence the outcome. These professionals are well-versed in local laws, and their expertise will guide you through the complex legal landscape. Having knowledgeable counsel can protect your rights while also advocating for your child's best interests.

Many regions also provide access to mediation services that can facilitate smoother discussions between parents. Mediation can help mitigate conflict and establish terms beneficial for all parties, particularly the child.

Importance of Communication Between Co-Parents

Effective communication between co-parents is essential for fostering a supportive environment for children moving through divorce. This requires consistent dialogue regarding schedules, activities, and any changes that may arise in everyday life. Establishing clear lines of communication can help preempt misunderstandings and cultivate a cooperative parenting relationship.

Moreover, utilizing shared applications or calendars can provide a practical solution to managing important dates and events, ensuring both parents remain informed and engaged in their child's life. Investing time and effort into open communication pays dividends in strengthening familial bonds amidst changes.

Planning for the Future: Investments and Savings

Understanding Your Financial Landscape

After a divorce, it’s crucial to take stock of your financial situation. This includes assessing assets, liabilities, and future obligations related to child custody. You might feel overwhelmed, but knowing where you stand financially is the first step in making informed decisions. Understanding your net worth and cash flow can help in budgeting and planning for future investments.

A detailed review of your financial documents, including tax returns, bank statements, and investment accounts, will help you gain clarity. Consider working with a financial advisor to interpret complex financial statements or negotiate better terms with creditors.

Creating a Sustainable Budget

- Identify essential and non-essential expenses.

- Consider future needs related to children, such as education costs.

- Set up an emergency fund to cover unforeseen expenses.

Developing a budget is essential for maintaining financial stability post-divorce. Focus on differentiating between your needs and wants, especially when it comes to the well-being of your children. A realistic budget should reflect current income and anticipated expenses associated with child custody.

It’s important to revisit and adjust your budget periodically. Life circumstances can change, and your financial plan needs to reflect that to ensure long-term sustainability.

Evaluating Investment Options

Once you have a handle on your budget, consider your investment strategies. It's advisable to avoid impulsive decisions driven by emotional stress. Instead, focus on long-term growth through diversified investments such as stocks, bonds, or mutual funds. Consulting with a financial expert can provide insights tailored to your specific financial situation.

Real estate might also be worth exploring, especially if you plan to keep your family home or invest in rental properties. Each investment option comes with its own risk profile, so understanding these risks is vital.

Building an Emergency Fund

Creating an emergency fund should be a priority for single parents. This fund can act as a safety net during times of uncertainty. Consider aiming to save at least three to six months' worth of living expenses. This buffer will support you without the necessity of high-interest loans during unexpected financial challenges.

Remember to regularly contribute to this fund, even if the amounts are small. Consistency is key; over time, your savings will accumulate significantly, providing peace of mind.

Long-term Financial Goals and Retirement Planning

Setting long-term financial goals is essential for holistic financial health. As you navigate through your post-divorce life, consider your retirement plans and how they align with your current financial situation. It's never too late to start saving for retirement, even if that means adjusting your expectations.

A good strategy is to educate yourself on retirement accounts like IRAs and 401(k)s. Understand potential employer matches or tax benefits associated with these accounts. Working with a financial planner can help determine realistic goals based on your new circumstances.

Seeking Professional Guidance for Comprehensive Support

Understanding the Role of Financial Advisors Post-Divorce

Seeking the expertise of a financial advisor can be a pivotal step after a divorce. These professionals help navigate complex financial landscapes, ensuring that all assets and liabilities are accounted for. Working with a seasoned advisor allows individuals to optimize their financial portfolios effectively. Their guidance can simplify decision-making related to child support, alimony, and asset division.

Financial advisors often employ various strategies tailored to individual circumstances. They may suggest specific investment vehicles to secure a stable future for clients and their children. This personalized approach becomes even more crucial when there are children involved, as the advisor will focus on long-term planning to ensure financial security.

Furthermore, many advisors offer resources such as workshops and educational materials to help clients understand their financial obligations better. Knowing how to manage finances post-divorce can empower former spouses and foster a sense of control in their new lives.

Navigating Child Custody Implications on Financial Planning

- Child custody arrangements significantly influence financial obligations.

- Understanding state laws regarding child support is essential for compliance.

- Long-term financial planning should account for educational and healthcare expenses of children.

When developing a financial plan post-divorce, it's crucial to consider how child custody arrangements affect overall finances. Each custody agreement brings unique financial responsibilities, which need to be factored into budget planning. For instance, shared custody often leads to split costs for education and healthcare, while sole custody might require a more significant financial commitment from one parent.

Legal advice is indispensable for understanding the implications of custody on financial obligations. State laws vary considerably regarding child support calculations and adjustments based on changes in income or custody status. Therefore, staying informed about these laws helps individuals navigate potential disputes and ensures compliance, reducing stress and fostering healthy co-parenting.

Long-Term Financial Strategies After Separation

Establishing long-term financial goals is essential for those who have recently experienced a divorce. This process should start by reassessing one’s income sources and expenses, as some costs may have changed due to the separation. Setting a budget to outline monthly expenses helps maintain financial health during this transition.

Additionally, planning for retirement is often overlooked post-divorce. This is a critical time to review retirement accounts, especially if there was a division of assets. It's vital to understand the tax implications of these changes and how they impact your long-term financial strategy.

Lastly, consider diversification of income streams to enhance financial stability. Engaging in part-time work or investing in education can open up new career opportunities, which may lead to increased earnings. Overall, embracing a proactive approach in financial planning can significantly ease the transition after divorce.