legal advice for divorce asset split

Protecting Your Financial Future After Divorce

Understanding the Legal Framework for Asset Division

Divorce necessitates a thorough understanding of the legal framework governing asset division. This framework varies by jurisdiction and can be complex, encompassing community property, separate property, and equitable distribution principles. Understanding these distinctions is crucial for navigating the process effectively and ensuring your rights are protected. This legal framework often dictates how marital assets, acquired during the marriage, are divided between the divorcing parties.

Legal counsel can provide invaluable assistance in interpreting these complex rules and ensuring that your interests are represented accurately throughout the proceedings. They can advise on the specific laws in your jurisdiction and help you understand the potential implications of different division strategies.

Strategies for Identifying and Valuing Assets

A critical first step in protecting your financial future is identifying and accurately valuing all assets. This includes not only bank accounts and real estate but also retirement accounts, pensions, investment portfolios, and any other valuable possessions. Thorough documentation is essential for proving the existence and value of these assets, and proper valuation methods must be employed to reflect their true worth. This meticulous process can significantly impact the eventual division of assets.

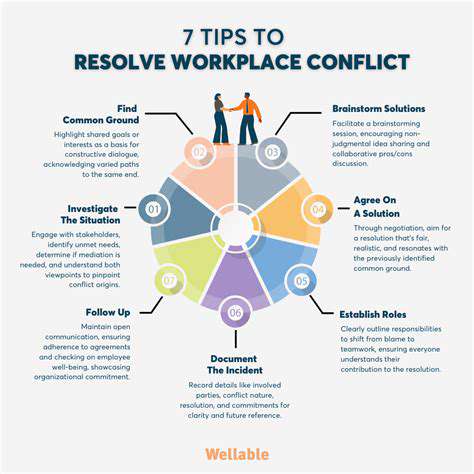

Negotiation and Mediation: Alternatives to Litigation

Negotiation and mediation offer alternative dispute resolution methods that can be significantly less costly and time-consuming than formal litigation. These processes allow divorcing parties to work collaboratively toward a mutually agreeable settlement, fostering a more amicable resolution. Mediation, in particular, utilizes a neutral third party to facilitate communication and help parties reach a compromise on asset division and other critical issues.

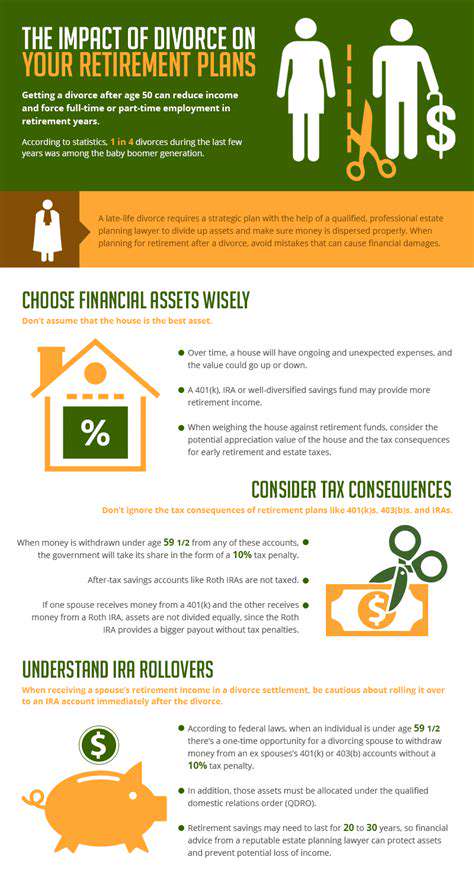

Protecting Your Retirement Accounts During Divorce

Retirement accounts, often representing a significant portion of a couple's accumulated wealth, require careful consideration during divorce proceedings. Federal and state laws often dictate how these accounts are divided. Failing to understand the implications of these rules can lead to significant financial setbacks. Seeking legal counsel is crucial in navigating these complexities and ensuring your retirement savings are protected and fairly divided.

Addressing Spousal Support and Alimony Obligations

Understanding spousal support or alimony obligations is vital for securing your financial future after divorce. The determination of spousal support often depends on the length of the marriage, the earning capacity of each spouse, and the contribution of each spouse to the marital estate. The legal framework governing spousal support can be complex, and an experienced attorney can help you understand your rights and obligations in this area.

Planning for Your Post-Divorce Financial Future

Divorce often necessitates significant adjustments to your financial planning. This includes developing a post-divorce budget, exploring potential income streams, and creating a plan for managing your financial responsibilities. Considering tax implications and potential future financial needs is essential for securing your financial well-being after the divorce process. This step is vital to ensure your financial independence and stability in the future.

Read more about legal advice for divorce asset split

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases